When you envision retirement, you probably see yourself living comfortably, doing what makes you happy. Your dreams could be as lofty as traveling the world or as simple as spending more time with your friends and family. Everyone’s vision is unique.

Fortunately, whatever your dream, your employer wants to help you make it reality — by offering a retirement savings plan. Here’s why you should consider taking full advantage of your plan.

Enhance your income strategy

Like so many other major life events, a successful retirement depends on advance planning. No matter what your age, now is the time to start thinking about where your retirement income will come from. Several possible resources may be available.

For instance, some people assume that Social Security will meet all of their retirement income needs. Others believe that Social Security will dry up before they retire. While no one can say exactly what the future holds, the truth probably falls somewhere in the middle.

While some retirees get just a small percentage of their income from Social Security, others rely on the program as their only income source. As you think about how Social Security will fit into your plan, consider that it was never intended to be a retiree’s only source of income. Social Security is meant as a safety net to help keep people out of poverty.

Another possible income resource is a traditional pension plan. These employer-provided plans, which reward long-term employees with a steady stream of income in retirement, were common during the twentieth century. Over the past couple of decades, however, traditional pension plans have become increasingly scarce. Even if you are one of the lucky ones who will receive traditional pension income in retirement, you may still need an extra cushion to be able to retire comfortably.

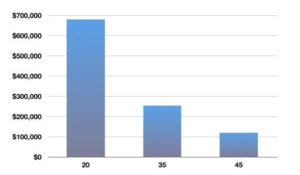

The cost of waiting

The younger you are, the less likely it is that saving for retirement is a high priority. If you fall into this category, consider this: Time can be one of your greatest advantages. Delaying your savings plan has the potential to be a costly mistake.

For example, say you invest $3,000 every year beginning at age 20. If your investments earn 6% per year, your account would be worth $680,000 at age 65. If you wait until age 35 to begin saving, your account would be worth just $254,000 at age 65. And what happens if you put off saving until age 45? In that case, you would accumulate just $120,000 by age 65. In this example, a 25-year delay cost you more than half a million dollars.

|

Of course, bear in mind that this example is hypothetical and for illustrative purposes only. It assumes a fixed 6% rate of return; however, no investment return can be guaranteed. The rate of return on your account will change over time. This example also does not take into account taxes or investment fees, which would reduce the performance shown if they were included. Withdrawals from your retirement savings plan are taxed at then-current rates, and distributions prior to age 59½ are subject to a 10% penalty tax, unless an exception applies (special rules apply to Roth accounts).

Current and future benefits

When utilized wisely, an employer-sponsored retirement savings plan can become your most important tool in planning for retirement. Your plan offers several benefits, including convenience (and possibly free money), tax advantages, and a variety of investments to choose from. Here’s a quick snapshot:

- Convenience: When you participate in an employer-sponsored plan, your contributions are deducted automatically from your paycheck. Known as “payroll deduction,” this process makes contributing to your plan easy and automatic — you pay yourself first before you even receive the money. In addition, some plans offer an employer match, which is essentially free money. If your plan offers a match, be sure to contribute at least enough to get the full amount of your employer contribution.

- Tax advantages: Depending on the type of plan offered, you may be able to cut your tax bill both now and in the future. With a traditional 401(k)-type savings plan, contributions are deducted from your pay before income taxes are assessed. This method of “pre-tax” saving reduces your taxable income, and therefore the amount of tax you pay Uncle Sam each year that you participate in your plan. In addition, your investments benefit from tax deferral, which means you don’t have to pay taxes on your pre-tax contributions, any employer contributions, and any earnings until you withdraw the money. Some employers also offer Roth accounts as part of the plan. With Roth accounts, you don’t receive an immediate tax benefit, but qualified withdrawals are tax free.*

- Investment choice: Your plan offers a variety of investment options to choose from, so that you can put together a strategy that pursues your goals within a comfortable level of risk. Depending on the specific offerings in your plan, you may be able to combine a mix of investments or choose a single one designed to meet your investment needs.

*Withdrawals from non-Roth plans and non-qualified withdrawals from Roth plans will be taxed at then-current rates. In addition, early withdrawals will be subject to a 10% penalty tax, unless an exception applies.

It’s up to you

Your employer-sponsored plan offers an important opportunity. Take the first step toward turning your retirement dreams into reality by participating in your retirement savings plan.

Why save for retirement?

Because people are living longer. According to the National Center for Health Statistics, the average 65-year-old American can expect to live about 20 more years.*

*Source: NCHS Data Brief, Number 328, November 2018

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.