24.3 million – Estimated number of 401(k) accounts left with former employers as of May 2021, with 2.8 million more left behind each year. If you have retirement assets with a former employer, you can leave them in the plan. But for more control, you can roll your assets to an IRA or to a new employer plan (if allowed) — both of which can preserve tax-advantaged status — or cash out, which will typically incur income taxes.

Source: Financial Planning, August 31, 2021

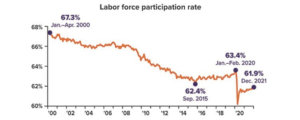

The labor force participation rate — the percentage of Americans age 16 and older who are working or actively looking for work — peaked in early 2000, when it began to drop due to aging baby boomers and more young people in college. Participation was rising before plummeting at the onset of the pandemic.

The rate has only partially recovered due in large part to accelerated retirement among workers age 55 and older. Other reasons include fewer child-care workers, reduced immigration, and many workers unwilling to return to low-paying jobs. Some experts believe it may never return to pre-pandemic levels. The question for the U.S. economy is whether technology and other productivity measures can maintain economic growth with a smaller percentage of the population in the workforce.

Sources: U.S. Bureau of Labor Statistics, 2016 & 2022; The Wall Street Journal, October 14, 2021; CNN, December 15, 2021

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.