March is Women’s History Month. What better time to reflect on the contribution women have made to the field of finance? What follows are the stories of just five of the many women who helped blaze the trail for others in investing, banking, finance, and economics.

Victoria Claflin Woodhull and Tennessee “Tennie” Claflin

Victorian-era sisters Victoria Woodhull and Tennie Claflin were pioneers on many fronts. Not only did they launch the first brokerage house by and for women, they started a progressive newspaper supporting women’s rights and were also suffragists. In 1872, Woodhull was the first woman to run for president.

The sisters’ rise to fame had quite unconventional beginnings. Their father was a “snake oil salesman” who made his young girls serve as psychics and healers in his scams. Woodhull later parlayed this unusual experience into a business relationship with the superstitious tycoon Cornelius Vanderbilt. With the backing of his fortune, the sisters opened Woodhull, Claflin & Co., New York’s first female-owned brokerage firm. Through surreptitious means (a hidden back door and a women-only lounge), the company helped women manage their own money during a time when it was frowned upon to do so.1

Maggie Lena Walker

Maggie Lena Walker was born to enslaved parents in 1864 in Richmond, Virginia. At just 14 years old, she joined the local council of the Independent Order of St. Luke, an African-American benevolent society that aided the sick and elderly, promoted humanitarian causes, and encouraged individual self-sufficiency. Walker eventually assumed leadership of the organization, where she served until her death. Among her achievements were launching The St. Luke Herald newspaper, which encouraged economic independence and, in 1903, becoming the first African-American woman to charter a bank — the St. Luke Penny Savings Bank.

Upon opening, the bank helped hundreds begin saving money, including one person who opened an account with just 31 cents. Walker also encouraged children to save by handing out penny banks and allowing them to open accounts after saving 100 pennies.

The bank later merged with two others to become The Consolidated Bank and Trust Company, the nation’s oldest bank continually operated by African-American management until 2009.2

Muriel Siebert

The first woman to buy a seat on the New York Stock Exchange (NYSE) and the first to be a superintendent of banking for the state of New York, Muriel Siebert was also the first woman to lead a NYSE member firm.

Considered “a scrapper” with “the same brash attitude that characterized Wall Street’s most successful men,” Siebert made it her life’s mission to fight for women to occupy the most vaunted seats at Wall Street’s proverbial tables. She donated millions to help women secure careers in business and finance.

At a 1992 luncheon where she was honored for her life’s work, Siebert said women “…are still not making partner and are not getting into the positions that lead to the executive suites. There’s still an old-boy network. You have to keep fighting.”3

Dr. Janet Yellen

Currently serving as U.S. Secretary of the Treasury — the first woman to do so — Dr. Janet Yellen has been a standout in the field of economics for decades.

Born to a middle-class family in Brooklyn, New York, Dr. Yellen graduated summa cum laude from Brown University in 1967 and earned her Ph.D. in economics from Yale in 1971, the only woman to do so that year. After teaching at several top universities, including Harvard and the London School of Economics, she served as a member of the Federal Reserve Board of Governors.

In 1997, President Bill Clinton appointed her as the first woman chair of the White House Council of Economic Advisors. She later went on to serve the Federal Reserve System in a variety of leadership roles. In October 2013, President Barack Obama nominated her for the position of Federal Reserve Board Chair, the first woman to hold that role.

Dr. Yellen is not only the first woman to lead the U.S. Treasury, the Federal Reserve Board, and the White House Council of Economic Advisors, she also is the first person to have held all three posts.4

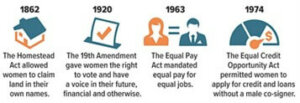

Milestones in Financial HERstory

1) Museum of the City of New York

2) National Park Service and the National Women’s History Museum

3) The New York Times, August 25, 2013

4) National Women’s History Museum and Investopedia

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.