The arrival of the COVID-19 pandemic in 2020 led to a surge in demand for vacation/second homes — mainly spurred by government shutdowns and stay-at-home advisories. Whether working remotely, attending school online, or meeting up with friends and family virtually, people found themselves spending more time than ever at home.1 If you are thinking about buying a vacation home, here are three things to consider before taking the plunge.

Tax Benefits

The tax treatment of your home will depend largely on how much time you (or a family member) use the property for personal purposes relative to the amount of time you rent it to others. If you plan to use the home for your personal use only, or rent it to others for fewer than 15 days per year, you can typically deduct property taxes, qualified residence interest, and casualty loss deductions. Rental income from a second home under these circumstances is not taxable and rental expenses are not deductible.

When you rent out your home for more than 15 days during the year, and your personal use of the home exceeds the greater of 14 days during the year or 10% of the days rented, then the property is considered a vacation home for tax purposes. You may deduct property taxes, qualified residence interest, and casualty loss deductions. However, rental expenses must be divided between personal and rental use, and deductible expenses are generally limited to the amount of income generated by the property. In addition, all rental income is reportable. Consider seeking advice from an independent tax or legal professional.

There are inherent risks associated with real estate investments and the real estate industry, each of which could have and adverse effect on the financial performance and value of a real estate investment. Some of these risks include: a deterioration in national, regional, and local economies; tenant defaults; local real estate conditions, such as an oversupply of, or a reduction in demand for, rental space; property mismanagement; changes in operating costs and expenses, including increasing insurance costs, energy prices, real estate taxes, and the costs of compliance with laws, regulations, and government policies. Real estate investments may not be appropriate for all investors.

Affordability

Though there may be some financial benefits to owning your own small piece of paradise (e.g., rental income, increase in property value), you should only purchase a vacation home if you crunched the numbers and find that you can truly afford it. In addition to a mortgage, you’ll have to pay property taxes and, depending on where the home is located, a higher premium for hazard and liability insurance. The amount of money you pay for electricity, heat, sewer, water, phone, and other utilities will depend on how frequently and how many people use/occupy the vacation home. And unless your home comes furnished, initially you will need to spend money on furniture, bedding, and housewares to make sure that your home is equipped and ready for use/occupancy.

You’ll also have to spend money on keeping up the home. Maintenance costs can include cleaning, yard work, pool or spa maintenance, plowing, and both major and minor repairs. If you’re buying a condo or a home that is part of a homeowners association, you’ll have to pay a monthly fee to cover maintenance/upkeep. Finally, if you are plan to rent out your vacation home, you may need to hire a property management company that will help you market, list, and maintain your rental property for a fee.

Investment Potential

Is the property located near a highly sought-after vacation destination? If so, it may turn out to be a good investment. Popular vacation rentals tend to increase in value over time, helping you build equity and accumulate wealth. In addition, it could generate enough rental income to help cover your mortgage and property taxes throughout the year.

If you vacation often enough, owning a vacation home could also end up saving you money in the long run. Compare the cost of your annual mortgage payments to what you normally pay for vacations during the year. You may be surprised to find that the costs are similar. Are you are planning for or nearing retirement? If so, you could buy a vacation home with the goal of eventually using it as your primary residence when you retire.

1) National Association of Realtors, 2021

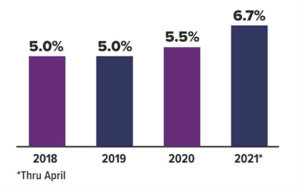

Share of Vacation Home Sales to Total Existing Home Sales

Source: National Association of Realtors, 2021

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.