The passage of the SECURE Act in 2019 effectively eliminated the stretch IRA, an estate planning strategy that allowed an inherited IRA to continue growing tax deferred, potentially for decades. Most nonspouse beneficiaries, including children and grandchildren, can no longer stretch distributions over their lifetimes. Moreover, proposed IRS regulations require most designated beneficiaries to take annual required minimum distributions (RMDs) within the 10-year distribution period if the original account owner died on or after his or her required beginning date. This shorter distribution period could result in unanticipated and potentially large tax bills for nonspouse beneficiaries who inherit high-value IRAs.

You may be looking for alternative ways to preserve your wealth and pass it on to your beneficiaries. Here are three options you might consider.

Roth Conversion

If you are willing to pay income taxes now instead of your beneficiary paying them later, you could convert your IRA to a Roth IRA. Anyone can convert a traditional IRA to a Roth IRA. However, you generally have to include the amount you convert in your gross income for the year converted. Not only would you have to pay taxes on the amount converted, but the beneficiaries of your Roth IRA will generally have to liquidate the account within 10 years of inheriting it, although they won’t pay federal income taxes on the distribution(s).

Life Insurance

You could take distributions from your IRA and use them to buy life insurance on your life. The beneficiaries you name in the life insurance policy will receive those proceeds tax-free at your death. The policy beneficiaries could use the tax-free proceeds of the life insurance to pay any income taxes they would owe on the balance of the IRA they inherit from you. Or, if you’ve been able to liquidate or spend down your IRA during your lifetime, the tax-free life insurance death benefit would replace some or all of the taxable IRA that otherwise would have been inherited by the beneficiaries.

Irrevocable Trust

You could create an irrevocable trust and fund it with non-IRA assets. An irrevocable trust can’t be changed or dissolved once it has been created. You generally can’t remove assets, change beneficiaries, or rewrite any of the terms of the trust. Often, life insurance is used to fund the irrevocable trust. You can direct how and when the trust beneficiaries are to receive the life insurance proceeds from the trust after your death. In addition, if you have given up control of the property, all of the property in the trust, plus any future appreciation on the property, is removed from your taxable estate.

Wealth Cache

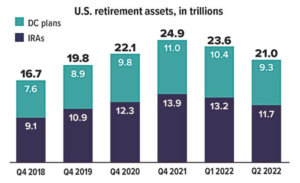

Assets held in individual retirement accounts (IRAs) and defined-contribution plans such as 401(k)s dipped in the first half of 2022 to $21 trillion. Even so, that total was up more than 25% from year-end 2018.

While trusts offer numerous advantages, they incur upfront costs and often have ongoing administrative fees. The use of trusts involves a complex web of tax rules and regulations. You should consider the counsel of an experienced estate planning professional and your legal and tax professionals before implementing such strategies.

As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. The cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. In addition, if a policy is surrendered prematurely there may be surrender charges and income tax implications. Any guarantees are subject to the financial strength and claims-paying ability of the insurer.

To qualify for the tax-free and penalty-free withdrawal of earnings, a Roth IRA must meet the five-year holding requirement, and the distribution must take place after age 59½ or due to the owner’s death, disability, or a first-time home purchase ($10,000 lifetime maximum). Under current tax law, if all conditions are met, the Roth IRA will incur no further income tax liability for the rest of the owner’s lifetime or for the lifetimes of the owner’s heirs, regardless of how much growth the account experiences.

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.