An estate plan is a map that explains how you want your personal and financial affairs to be handled in the event of your incapacity or death. Due to its importance and because circumstances change over time, you should periodically review your estate plan and update it as needed.

When Should You Review Your Estate Plan?

Reviewing your estate plan will alert you to any issues that need to be addressed. For example, you may need to make changes to your plan to ensure it meets all of your goals, or when an executor, trustee, or guardian can no longer serve in that capacity.

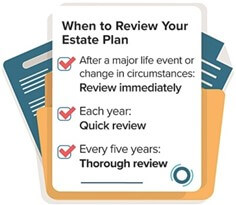

Although there’s no hard-and-fast rule, you’ll probably want to do a quick review each year, because changes in the economy and in the tax code often occur on an annual basis. At least every five years, do a more thorough review.

You should also revisit your estate plan immediately after a major life event or change in your circumstances.

- There has been a change in your marital status (many states have laws that revoke part or all of your will if you marry or get divorced) or that of your children or grandchildren.

- There has been an addition to your family through birth, adoption, or marriage (stepchildren).

- Your spouse or a family member has died, has become ill, or is incapacitated.

- Your spouse, your parents, or another family member has become dependent on you.

- There has been a substantial change in the value of your assets or in your plans for their use.

- You have received a sizable inheritance or gift.

- Your income level or requirements have changed.

- You are retiring.

- You have made (or are considering making) a change to any part of your estate plan.

Some Things to Consider

- Who are your family members and friends? What is your relationship with them? What are their circumstances in life? Do any have special needs?

- Do you have a valid will? Does it reflect your current goals and objectives about who receives what after you die? Is your choice of an executor or a guardian for your minor children still appropriate?

- In the event you become incapacitated, do you have a living will, durable power of attorney for health care, or do-not-resuscitate order to manage medical decisions?

- In the event you become incapacitated, do you have a living trust or durable power of attorney to manage your property?

- What property do you own and how is it titled (e.g., outright or jointly with right of survivorship)? Property owned jointly with right of survivorship passes automatically to the surviving owner(s) at your death.

- Have you reviewed your beneficiary designations for your retirement plans and life insurance policies? These types of property pass automatically to the designated beneficiaries at your death.

- Do you have any trusts, either living or testamentary? Property held in trust passes to beneficiaries according to the terms of the trust. (The use of trusts involves a complex web of tax rules and regulations, and usually involves upfront costs and ongoing administrative fees. You should consider the counsel of an experienced estate professional before implementing a trust strategy.)

- Do you plan to make any lifetime gifts to family members or friends?

- Do you have any plans for charitable gifts or bequests?

- If you own or co-own a business, have provisions been made to transfer your business interest? Is there a buy-sell agreement with adequate funding? Would lifetime gifts be appropriate?

- Do you own sufficient life insurance to meet your needs at death? Have those needs been evaluated?

- Have you considered the impact of gift, estate, generation-skipping, and income taxes, both federal and state?

This is just a brief overview. Each person’s situation is unique. An estate planning attorney may be able to assist you with this process.

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.