69% – Percentage of Americans using a buy now, pay later (BNPL) service in 2022 who carried over a credit card balance from one billing cycle to the next. A BNPL service allows consumers to pay for online purchases with interest-free payments, typically up to four payments spread over six weeks.

Source: Consumer Financial Protection Bureau, 2023

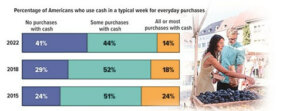

A growing number of Americans are going “cashless” for everyday purchases like groceries, gas, services, and meals compared to previous years. A cashless payment might be made using a debit or credit card, or a payment app or mobile wallet on a smartphone.

In 2022, about 41% of Americans said none of their purchases in a typical week were paid for using cash, up from 29% in 2018 and 24% in 2015. Among affluent households, 59% said they didn’t use cash for any typical weekly purchases. The trend of not carrying cash varies by age, with 54% of people under age 50 saying they don’t worry much about whether they have cash on hand compared to 28% of people 50 and older.

Source: Pew Research Center, 2022 (numbers do not equal 100% due to rounding)

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.