After pushing interest rates gradually upward for three years, the Federal Reserve dropped the benchmark federal funds rate to near zero (0%–0.25%) in March 2020 to help mitigate the economic damage caused by COVID-19.1 The funds rate affects many short-term interest rates, including the rates on money market mutual funds, which were already low to begin with.

The average monthly yield on 30-day taxable money market funds dropped steadily after the Fed’s move and was down to 0.03% by the end of 2020, equivalent to an annual percentage rate of about 0.36%.2 Considering the rock-bottom rates on some short-term investments, this is higher than might be expected but well below the rate of inflation.3 Even so, investors held about $4.3 trillion in money market funds.4

What’s the appeal with such a low return? Stability and liquidity.

Cash Alternatives

Money market funds are mutual funds that invest in cash alternatives, usually short-term debt. They seek to preserve a stable value of $1 per share and can generally be liquidated fairly easily.

Money market funds are typically used as the “sweep account” for clearing brokerage transactions, and investors often keep cash proceeds in the fund on a temporary basis while looking for another investment. In a volatile market, it’s not unusual to see large shifts into money market funds as investors pull out of riskier investments and wait for an opportunity to reinvest.

Short Term vs. Long Term

Money market funds can also be useful to keep emergency funds or other funds that might be needed quickly, such as a down payment on a home. If you are retired or near retirement, it might make sense to use money market funds for near-term expenses and/or to hold funds in a traditional IRA for required minimum distributions, so you do not have to sell more volatile assets.

For a long-term investing strategy, however, money market funds are a questionable choice. You might keep some assets in these funds to balance riskier investments, but low yields over time can expose your assets to inflation risk — the potential loss of purchasing power — along with the lost opportunity to pursue growth through other investments. This could change if interest rates rise, but the Fed projects that the federal funds rate will remain in the 0% to 0.25% range through the end of 2023.5

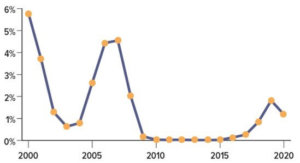

Annual Returns on Money Market Mutual Funds

Source: Refinitiv, 2021, 30-Day Money Market Index — All Taxable, for the period 12/31/1999 to 12/31/2020. The performance of an unmanaged index is not indicative of the performance of any specific security. Individuals cannot invest directly in an index. Past performance is not a guarantee of future results. Actual results will vary.

Money market funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in such a fund.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1, 5) Federal Reserve, 2020

2) Refinitiv, 30-Day Money Market Index — All Taxable, for the period 12/31/2019 to 12/31/2020

3) U.S. Bureau of Labor Statistics, 2021

4) Investment Company Institute, 2021 (data as of 12/29/2020)

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.