4.6% – Annual rate of “supercore” inflation in April 2023. Supercore is a metric that excludes goods, food, energy, and shelter, which are all categories that have been especially volatile over the last year. By contrast, the Consumer Price Index for all items increased 4.9%.

Source: Bloomberg, May 26, 2023

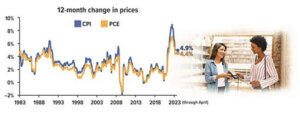

Economists and investors rely on the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) Price Index to track the path of inflation over time. The two indexes use different formulas and data sources — CPI gets data from consumers and PCE data comes from businesses. PCE is broader in scope and some expenditure categories are weighted very differently. In late 2022, the difference between annual inflation as measured by CPI and PCE was the widest it has been since the 1980s.

Sources: U.S. Bureau of Labor Statistics, 2023; U.S. Bureau of Economic Analysis, 2023 (data through April 2023)

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.