Mortgage refinancing applications surged in the second week of March 2020, jumping by 79% — the largest weekly increase since November 2008. As a result, the Mortgage Bankers Association nearly doubled its 2020 refinance originations forecast to $1.2 trillion, the strongest refinance volume since 2012.1

Low mortgage interest rates have prompted many homeowners to think about refinancing, but there’s a lot to consider before filling out a loan application.

1. What is your goal?

Determine why you want to refinance. Is it primarily to reduce your monthly payments? Do you want to shorten your loan term to save interest and possibly pay off your mortgage earlier? Are you interested in refinancing from one type of mortgage to another (e.g., from an adjustable-rate mortgage to a fixed-rate mortgage)? Answering these questions will help you determine whether refinancing makes sense and which type of loan might best suit your needs.

2. When should you refinance?

A general guideline is not to refinance unless interest rates are at least 2% lower than the rate on your current mortgage. However, even a 1% to 1.5% differential may be worthwhile to some homeowners.

To determine this, you should factor in the length of time you plan to stay in your current home, the costs associated with a new loan, and the amount of equity you have in your home. Calculate your break-even point (when you’ll begin to save money after paying fees for closing costs). Ideally, you should be able to recover your refinancing costs within one year or less.

While refinancing a 30-year mortgage may reduce your monthly payments, it will start a new 30-year period and may increase the total amount you must pay off (factoring in what you have paid on your current loan). On the other hand, refinancing from a 30-year to 15-year loan may increase monthly payments but can greatly reduce the amount you pay over the life of the loan.

3. What are the costs?

Refinancing can often save you money over the life of your mortgage loan, but this savings can come at a price. Generally, you’ll need to pay up-front fees.

Typical costs include the application fee, appraisal fee, credit report fee, attorney/legal fees, loan origination fee, survey costs, taxes, title search, and title insurance. Some loans may have a prepayment penalty if you pay off your loan early.

4. What are the steps in the process?

Start by checking your credit score and history. Just as you needed to get approval for your original home loan, you’ll need to qualify for a refinance. A higher credit score may lead to a better refinance rate.

Next, shop around. Compare interest rates, loan terms, and refinancing costs offered by multiple lenders to make sure you’re getting the best deal. Once you’ve chosen a lender, you will submit financial documents (such as tax returns, bank statements, and proof of homeowners insurance) and fill out an application. You may also be asked for additional documentation or a home appraisal.

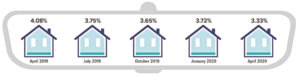

Rear-View Look at Mortgage Rates

In a single year, the average rate for a 30-year mortgage fell by 0.75%. Low mortgage interest rates often prompt homeowners to refinance.

Source: Freddie Mac, 2020 (data as of first week of April 2020)

1) Mortgage Bankers Association, March 11, 2020

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.