The Roth “five-year rule” typically refers to when you can take tax-free distributions of earnings from your Roth IRA, Roth 401(k), or other work-based Roth account. The rule states that you must wait five years after making your first contribution, and the distribution must take place after age 59½, when you become disabled, or when your beneficiaries inherit the assets after your death. Roth IRAs (but not workplace plans) also permit up to a $10,000 tax-free withdrawal of earnings after five years for a first-time home purchase.

While this seems straightforward, several nuances may affect your distribution’s tax status. Here are four questions that examine some of them.

1. When does the clock start ticking?

“Five-year rule” is a bit misleading; in some cases, the waiting period may be shorter. The countdown begins on January 1 of the tax year for which you make your first contribution.

For example, if you open a Roth IRA on December 31, 2020, the clock starts on January 1, 2020, and ends on January 1, 2025 — four years and one day after making your first contribution. Even if you wait until April 15, 2021, to make your contribution for tax year 2020, the clock starts on January 1, 2020.

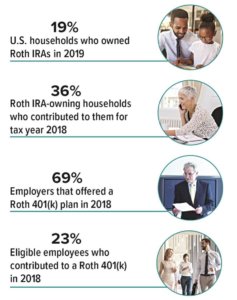

Roth by the Numbers

2. Does the five-year rule apply to every account?

For Roth IRAs, the five-year clock starts ticking when you make your first contribution to any Roth IRA.

With employer plans, each account you own is subject to a separate five-year rule. However, if you roll assets from a former employer’s 401(k) plan into your current Roth 401(k), the clock depends on when you made the first contribution to your former account. For instance, if you first contributed to your former Roth 401(k) in 2014, and in 2020 you rolled those assets into your new plan, the new account meets the five-year requirement.

3. What if you roll over from a Roth 401(k) to a Roth IRA?

Proceed with caution here. If you have never previously contributed to a Roth IRA, the clock resets when you roll money into the Roth IRA, regardless of how long the money has been in your Roth 401(k).

Therefore, if you think you might enact a Roth 401(k) rollover sometime in the future, consider opening a Roth IRA as soon as possible. The five-year clock starts ticking as soon as you make your first contribution, even if it’s just the minimum amount and you don’t contribute again until you roll over the assets.1

4. What if you convert from a traditional IRA to a Roth IRA?

In this case, a different five-year rule applies. When you convert funds in a traditional IRA to a Roth IRA, you’ll have to pay income taxes on deductible contributions and tax-deferred earnings in the year of the conversion. If you withdraw any of the converted assets within five years, a 10% early-distribution penalty may apply, unless you have reached age 59½ or qualify for another exception. This rule also applies to conversions from employer plans.2

1 You may also leave the money in your former employer’s plan, roll the money into another employer’s Roth account, or receive a lump-sum distribution. Income taxes and a 10% penalty tax may apply to the taxable portion of the distribution if it is not qualified.

2 Withdrawals that meet the definition of a “coronavirus-related distribution” during 2020 are exempt from the 10% penalty.

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.