The opportunity to acquire company stock — inside or outside a workplace retirement plan — can be a lucrative employee benefit. Your compensation may include stock options or bonuses paid in company stock. Shares may be offered at a discount through an employee stock purchase plan and held in a taxable account, or company stock might be one of the investment options in your tax-deferred 401(k) plan.

Either way, having too much of your retirement savings or net worth invested in your employer’s stock could become a problem if the company or sector hits hard times, especially if a job loss and stock value loss occur at the same time. There are also tax implications to consider.

Concentrate on Diversification

The possibility of heavy losses from having a large portion of your portfolio holdings in one investment, asset class, or market segment is known as concentration risk. Buying shares of any individual stock carries risks specific to that company or industry, so a shift in market forces, regulation, technology, competition, scandals, and other unexpected events could damage the value of the business.

Holding more than 10% to 15% of your assets in company stock could upend your retirement strategy if the stock suddenly declines in value, and overconcentration can sneak up on you as your position builds slowly over time. To help maintain a healthy level of diversification in your portfolio, look closely at your plan’s investment options and consider directing some of your contributions into funds that provide exposure to a wider variety of market sectors.

You might also consider strategies that involve selling company shares systematically or right after they become vested. But make sure you are aware of the rules, restrictions, and time frames for liquidating company stock, as well as any tax consequences.

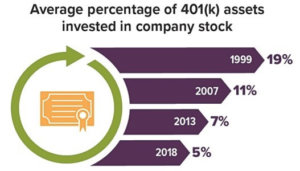

Company Stock Ownership Has Fallen

Source: Employee Benefit Research Institute, 2021 (data from participants in the 2018 EBRI/ICI 401(k) database)

Take Advantage of NUA

If you sell stock inside your 401(k) account and reinvest in other plan options, or you roll the stock over to an IRA, future distributions will likely be taxed as ordinary income. However, if you own highly appreciated company stock in your employer plan, you might benefit from a special tax break on lump-sum distributions of net unrealized appreciation (NUA).

NUA allows the appreciation on company stock in a 401(k) to be taxed at lower long-term capital gains rates when the shares are sold, instead of the ordinary income tax rates that would otherwise apply to retirement plan distributions.

To qualify for NUA, the lump-sum distribution must follow a triggering event such as separation from service, reaching age 59½, disability, or death. The stock must be distributed in kind — as stock — and transferred to a taxable account. You would owe income tax at the ordinary rate in the year of the distribution, but only on the cost basis of the stock.

If your retirement plan consists of employer stock and other types of investments (cash, mutual funds, etc.), the other assets can be transferred into an IRA, to another employer’s plan, or withdrawn entirely. This doesn’t have to happen simultaneously with the stock distribution, but the distributions must occur in the same tax year, and the account balance on your employer plan must be zero by the end of that year.

If distributions of company stock are handled correctly, the savings from NUA can be substantial, especially for those in higher tax brackets. But keep in mind that taking any partial distribution from your employer plan after a triggering event — even an in-plan Roth conversion or required minimum distribution — could disqualify you from the NUA tax break, unless another triggering event occurs.

All investments are subject to market fluctuation, risk, and loss of principal. When sold, investments may be worth more or less than their original cost.

Diversification and asset allocation are methods used to help manage investment risk; they do not guarantee a profit or protect against investment loss.

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.