Publicly traded companies are required to disclose their financial performance to regulators and shareholders on a quarterly basis. News organizations and investors pay close attention to these reports because they tend to impact stock prices, with strong earnings driving share prices up, and vice versa.

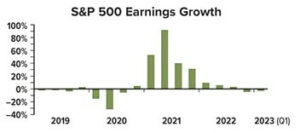

In the first quarter of 2023, the earnings of companies in the S&P 500 Index declined 2.2%. This was a much stronger showing than Wall Street analysts expected after profits fell 4.6% in the previous quarter. On a positive note, revenues grew 2.9% in Q1 as consumer spending faced down inflation.1–2

Earnings season can be a volatile six-week period for stocks. As investors digest and respond to new data, the marketplace rewards some companies and punishes others.

Hindsight Offers Perspective

Stock prices tend to be forward looking, which is one reason they don’t always move in the same direction as earnings. For example, the S&P 500 Price Index returned nearly 29% in 2019 and more than 16% in 2020, even though earnings growth was negative in six of those eight quarters.

Sources: FactSet, 2023; S&P Dow Jones Indices, 2023

Measuring Performance

A quarterly report typically includes unaudited financial statements, a discussion of the business conditions that affected financial results, and some guidance about how the company expects to perform in the following quarters. Financial statements reveal the quarter’s profit, or net income, which must be calculated according to generally accepted accounting principles (GAAP). This typically involves subtracting operating expenses (including depreciation, taxes, and other expenses) from gross income.

Pro-forma (or adjusted) earnings may present an alternative view of financial performance by excluding nonrecurring expenses such as restructuring costs, interest payments, taxes, and other unique events. Although the Securities and Exchange Commission has rules governing pro-forma financial statements, companies still have a great deal of leeway to highlight the positive and minimize the negative in these reports. There may be a vast difference between pro-forma and GAAP earnings.

Earnings per share (EPS) represents the portion of total profit that applies to each outstanding share of company stock. EPS is often the figure that makes headlines, and the financial media tends to focus on whether companies meet, beat, or fall short of the consensus estimate of Wall Street analysts. A company can see its stock price surge by losing less money than expected or can log billions in profits and still disappoint investors who were counting on more.

Shaping Perception

Due to the potential effect on stock prices, companies often take steps to avoid big surprises, mostly by managing the market’s expectations. This may involve issuing profit warnings or positive revisions to previous forecasts, which may cause analysts to adjust their estimates accordingly. Companies may also be able to time certain business moves to help meet quarterly earnings targets.

In addition to filing regulatory paperwork, many companies announce their results through press releases, conference calls, and/or webinars so they can try to influence how the information is judged by analysts, the financial media, and investors.

Diving Deeper

Investors who look beyond the headline performance metrics may find other meaningful details in a company’s quarterly report. Expansion plans, research and development, new products, consumer trends, government policies, and shifts in domestic or global economic conditions can all affect a company’s financial results, either immediately or in the future.

Bear in mind that reported earnings generally reflect the company’s recent performance, which in some cases may have little to do with its longer-term prospects. Moreover, some companies and/or industry sectors are likely in a better position to withstand economic challenges than others.

The return and principal value of stocks fluctuate with changes in market conditions. Shares, when sold, may be worth more or less than their original cost. The S&P 500 Index is an unmanaged group of securities considered to be representative of the U.S. stock market in general. The performance of an unmanaged index is not indicative of the performance of any specific investment. Individuals cannot invest directly in an index. Past performance is no guarantee of future results. Actual results will vary.

1) FactSet, 2023

2) The Wall Street Journal, April 30, 2023

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.