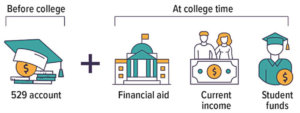

Busy, cash-strapped parents might welcome all the help they can get when saving for college. Building a college fund, even a small one, can help families feel more in control and less stressed during the college research and admission process. Think of a college fund as a down payment. Then at college time, it can be supplemented by financial aid (grants, scholarships, loans, and work-study), current income, and student funds. A good benchmark is to try and save at least 50% of your child’s projected college costs, but any amount is better than nothing.

A 529 savings plan can be instrumental in building a college fund. This individual investment account offers the opportunity for tax-free earnings if the funds are used for college, making every dollar count. (For withdrawals not used for qualified education expenses, earnings may be subject to taxation as ordinary income and a 10% penalty.) You can set up monthly electronic fund transfers from your bank account to put your savings on autopilot. But one-off contributions are allowed, too, and the holidays can be an excellent time for grandparents or other relatives to make a small contribution as a gift. The new year is also a good time to re-double your efforts on building a college fund.

Here are some common questions on opening a 529 savings account.

Can I open a 529 savings account in any state’s plan?

Yes. Currently, all states except Wyoming offer one or more 529 savings plans, and they are generally open to residents of any state. However, it’s a good idea to look at your own state’s 529 plan first, because some states may restrict any tax benefits (e.g., tax deduction for contributions, tax-free earnings) to residents who participate only in the in-state plan. Why open an account in another state’s 529 plan? There could be a number of reasons, including a wider range of investment options, a solid investment track record, an excellent investment manager, or lower management fees. For a list of all 529 plans by state, visit the Saving for College website.

What happens if I open a 529 plan in one state and then move to another state?

Essentially nothing. You can simply leave the account open and keep contributing to it. Alternatively, you can switch to a different 529 plan by rolling over the assets from the original plan to a new 529 plan. You can keep the same beneficiary (under IRS rules, you are allowed one 529 plan same-beneficiary rollover once every 12 months), but check the details of each plan for any potential restrictions. If you decide to stay with your original 529 plan, just remember that your new state might limit any potential 529 plan tax benefits to residents who participate in the in-state plan.

Should I open one 529 account for both of my kids or a separate account for each?

That depends on your personal preferences, but opening separate accounts often makes sense. Two accounts let you contribute different amounts for each child as needed, tailor your investment portfolios to each child’s age, and avoid commingling funds. If you choose one account and invest too aggressively, you might incur losses when your older child is close to college. And if you invest too conservatively, your investment returns may not keep pace with college inflation for your younger child. You also run the risk of depleting most or all of the funds for your oldest child.

How a 529 Account Helps at College Time

Does it make sense to open a 529 account if my child is a few years from college?

It might. Even if your child is only a few years from college, you could theoretically save for another four or five years, right up through junior year of college. You could open a 529 account, contribute monthly, and any earnings would be tax-free if the money is used for college. Having a designated college account instead of a general savings account might also lessen the temptation to dip into it for non-college expenses.

As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also the risk that the investments may lose money or not perform well enough to cover college costs as anticipated. The tax implications of a 529 plan should be discussed with your legal and/or tax professionals because they can vary significantly from state to state. Most states offering their own 529 plans may provide advantages and benefits exclusively for their residents and taxpayers, which may include financial aid, scholarship funds, and protection from creditors. Before investing in a 529 plan, consider the investment objectives, risks, charges, and expenses, which are available in the issuer’s official statement and should be read carefully. The official disclosure statements and applicable prospectuses, which contain this and other information about the investment options, underlying investments, and investment company, can be obtained by contacting your financial professional.

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.