Tax filing season is here again. If you haven’t done so already, you’ll want to start pulling things together — that includes getting your hands on a copy of your 2021 tax return and gathering W-2s, 1099s, and deduction records. You’ll need these records whether you’re preparing your own return or paying someone else to prepare your tax return for you.

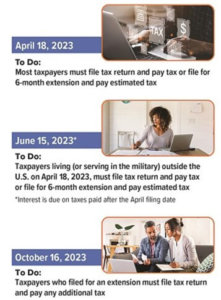

Don’t procrastinate. The filing deadline for individuals is generally Tuesday, April 18, 2023.

Filing for an Extension

If you don’t think you’re going to be able to file your federal income tax return by the due date, you can file for and obtain an extension using IRS Form 4868, Application for Automatic Extension of Time to File

U.S. Individual Income Tax Return. Filing this extension gives you an additional six months (to October 16, 2023) to file your federal income tax return. You can also file for an extension electronically — instructions on how to do so can be found in the Form 4868 instructions.

Due Dates for 2022 Tax Returns

Filing for an automatic extension does not provide any additional time to pay your tax. When you file for an extension, you have to estimate the amount of tax you will owe and pay this amount by the April filing due date. If you don’t pay the amount you’ve estimated, you may owe interest and penalties. In fact, if the IRS believes that your estimate was not reasonable, it may void your extension.

Note: Special rules apply if you’re living outside the country or serving in the military and on duty outside the United States. In these circumstances, you are generally allowed an automatic two-month extension (to June 15, 2023) without filing Form 4868, though interest will be owed on any taxes due that are paid after the April filing due date. If you served in a combat zone or qualified hazardous duty area, you may be eligible for a longer extension of time to file.

What If You Owe?

One of the biggest mistakes you can make is not filing your return because you owe money. If your return shows a balance due, file and pay the amount due in full by the due date if possible.

If there’s no way that you can pay what you owe, file the return and pay as much as you can afford. You’ll owe interest and possibly penalties on the unpaid tax, but you’ll limit the penalties assessed by filing your return on time, and you may be able to work with the IRS to pay the remaining balance (options can include paying the unpaid balance in installments).

Expecting a Refund?

The IRS has stepped up efforts to combat identity theft and tax refund fraud. More aggressive filters that are intended to curtail fraudulent refunds may inadvertently delay some legitimate refund requests. In fact, the IRS is required to hold refunds on all tax returns claiming the earned income tax credit or the additional child tax credit until at least February 15.

Most filers, though, can expect a refund check to be issued within 21 days of the IRS receiving a tax return. However, note that in recent years the IRS has experienced delays in processing paper tax returns.

So if you are expecting a refund on your 2022 tax return, consider filing as soon as possible and filing electronically.

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.