Recent research from the U.S. Department of Health and Human Services suggests that most Americans turning age 65 will need long-term care support during their lifetimes.¹

If the need arises, how will you handle potential long-term care for yourself or a loved one? Planning for the consequences of aging in general, and long-term care in particular, will depend on your preferences and circumstances. A long-term care plan should account for the different types of care you may need and the different settings in which you might receive that care. These are the most common options.

Your Home

Given a choice, you might prefer to receive long-term care support in your own home. Family caregivers, friends, or trained homemakers could provide assistance with everyday tasks, and professionals such as nurses and home health aides could provide home health care. In addition, a variety of community support services may be available, including adult day-care centers and transportation services. In any case, receiving care at home offers a measure of independence in a familiar environment.

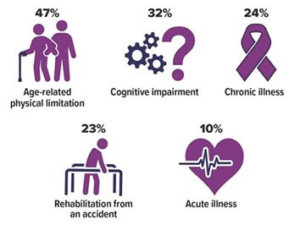

Reasons for Care

A 65-year-old has a nearly 70% chance of needing long-term care support and services at some point. The average length of long-term care in 2021 was 3.5 years, up from 3 years in 2018. People need care for a variety of reasons, but the most common is simply the physical limitations of aging.

Source: Genworth, 2021 (multiple responses allowed)

Community Care Retirement Communities (CCRCs)

Also known as life plan communities, CCRCs provide a range of services — from independent living to full-time skilled nursing care — all in the same location, allowing you to age in place. Most CCRCs combine housing options at one location and may include townhouses or cottages for independent living, assisted living apartments, and nursing home accommodations.

Assisted Living Facilities

If you want to remain independent but need some assistance with activities of daily living, you might choose to live in an assisted living facility. These home-like facilities offer housing, meals, and personal care services, but generally not medical or nursing services.

Nursing Homes

People who enter a nursing home usually have a disabling condition or cognitive disorder and can no longer take care of themselves. State-licensed nursing facilities offer more specialized skilled care, intermediate care, and custodial care. This is the most expensive way to receive long-term care.

Take some time to think about what the future might hold. Planning ahead can help ensure that you receive the type of care you need, in the setting that you prefer, as you grow older.

1) U.S. Department of Health and Human Services, 2021

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.