How much annual income will you need in retirement? If you aren’t able to answer this question, you’re not ready to make a decision about retiring. And, if it’s been more than a year since you’ve thought about it, it’s time to revisit your calculations. Your whole retirement income plan starts with your target annual income, and there are a significant number of factors to consider; start out with a poor estimate of your needs, and your plan is off-track before you’ve even begun.

General guidelines

It’s common to discuss desired annual retirement income as a percentage of your current income. Depending on whom you’re talking to, that percentage could be anywhere from 60% to 90%, or even more, of your current income. The appeal of this approach lies in its simplicity, and the fact that there’s a fairly common-sense analysis underlying it: Your current income sustains your present lifestyle, so taking that income and reducing it by a specific percentage to reflect the fact that there will be certain expenses you’ll no longer be liable for (e.g., payroll taxes) will, theoretically, allow you to sustain your current lifestyle.

The problem with this approach is that it doesn’t account for your specific situation. If you intend to travel extensively in retirement, for example, you might easily need 100% (or more) of your current income to get by. It’s fine to use a percentage of your current income as a benchmark, but it’s worth going through all of your current expenses in detail, and really thinking about how those expenses will change over time as you transition into retirement.

Factors to consider

It all starts with your plans for retirement — the lifestyle that you envision. Do you expect to travel extensively? Take up or rediscover a hobby? Do you plan to take classes? Whatever your plan, try to assign a corresponding dollar cost. Other specific considerations include:

- Housing costs: If your mortgage isn’t already paid off, will it be paid soon? Do you plan to relocate to a less (or more) expensive area? Downsize?

- Work-related expenses: You’re likely to eliminate some costs associated with your current job (for example, commuting, clothing, dry cleaning, retirement savings contributions), in addition to payroll taxes.

- Health care: Health-care costs can have a significant impact on your retirement finances (this can be particularly true in the early years if you retire before you’re eligible for Medicare).

- Long-term care costs: The potential costs involved in an extended nursing home stay can be catastrophic.

- Entertainment: It’s not uncommon to see an increase in general entertainment expenses like dining out.

- Children/parents: Are you responsible financially for family members? Could that change in future years?

- Gifting: Do you plan on making gifts to family members or a favorite charity? Do you want to ensure that funds are left to your heirs at your death?

Accounting for inflation

Inflation is the risk that the purchasing power of a dollar will decline over time, due to the rising cost of goods and services. If inflation runs at its historical long term average of about 3%, a given sum of money will lose half its purchasing power in about 23 years.

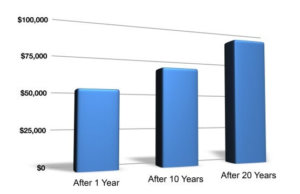

Assuming a consistent annual inflation rate of 3%, and excluding taxes and investment returns in general, if $50,000 satisfies your retirement income needs in the first year of retirement, you’ll need $51,500 of income the next year to meet the same income needs. In 10 years, you’ll need about $67,196. In other words, all other things being equal, inflation means that you’ll need more income each year just to keep pace.

How much will you need to equal $50,000 in today’s dollars given 3% inflation?

|

This hypothetical example is used for illustrative purposes only. Actual results will vary.

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.