Contributing to an employer-sponsored retirement plan or an IRA is a big step on the road to retirement, but contributing to both can significantly boost your retirement assets. A recent study found that, on average, individuals who owned both a 401(k) and an IRA at some point during the six-year period of the study had combined balances about 2.5 times higher than those who owned only a 401(k) or an IRA. And people who owned both types of accounts consistently over the period had even higher balances.1

Here is how the two types of plans can work together in your retirement savings strategy.

Convenience vs. Control

Employer-sponsored plans such as 401(k), 403(b), and 457(b) plans offer a convenient way to save through pre-tax salary deferrals, and contribution limits are high: $19,500 in 2021 ($20,500 in 2022) and an additional $6,500 if age 50 or older. Although the costs for investments offered in the plan may be lower than those offered in an IRA, these plans typically offer limited investment choices and have restrictions on control over the account.

IRA contribution limits are much lower: $6,000 in 2021 and 2022 ($7,000 if age 50 or older). But you can usually choose from a wide variety of investments, and the account is yours to control and keep regardless of your employment situation. If you leave your job, you can roll assets in your employer plan into your IRA.2 Whereas contributions to an employer plan generally must be made by December 31, you can contribute to an IRA up to the April tax filing deadline.

Matching and Diversification

Many employer plans match a percentage of your contributions. If your employer offers this program, it would be wise to contribute at least enough to receive the full match. Contributing more would be better, but you also might consider funding your IRA, especially if the contributions are deductible (see below).

Along with the flexibility and control offered by the IRA, holding assets in both types of accounts, with different underlying investments, could help diversify your portfolio. Diversification is a method used to help manage investment risk; it does not guarantee a profit or protect against investment loss.

Rules and Limits

Although annual contribution limits for employer plans and IRAs are separate, your ability to deduct traditional IRA contributions phases out at higher income levels if you are covered by a workplace plan: modified adjusted gross income (MAGI) of $66,000 to $76,000 for single filers and $105,000 to $125,000 for joint filers in 2021 ($68,000 to $78,000 and $109,000 to $129,000 in 2022).3 You can make nondeductible contributions to a traditional IRA regardless of income.

Eligibility to contribute to a Roth IRA phases out at higher income levels regardless of coverage by a workplace plan: MAGI of $125,000 to $140,000 for single filers and $198,000 to $208,000 for joint filers in 2021 ($129,000 to $144,000 and $204,000 to $214,000 in 2022).

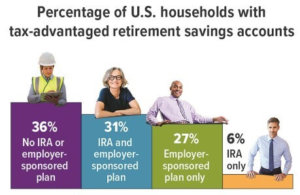

Source: Investment Company Institute, 2021

Contributions to employer-sponsored plans and traditional IRAs are generally made on a pre-tax or tax-deductible basis and accumulate tax deferred. Distributions are taxed as ordinary income and may be subject to a 10% federal income tax penalty if withdrawn prior to age 59½ (with certain exceptions). Nondeductible contributions to a traditional IRA are not taxable when withdrawn, but any earnings are subject to ordinary income tax. Required minimum distributions (RMDs) from employer-sponsored plans and traditional IRAs must begin for the year you reach age 72 (70½ if you were born before July 1, 1949). However, you are generally not required to take distributions from an employer plan as long as you still work for that employer.

Roth IRA contributions are not deductible, but they can be withdrawn at any time without penalty or taxes. To qualify for the tax-free and penalty-free withdrawal of earnings, Roth IRA distributions must meet a five-year holding requirement and take place after age 59½ (with certain exceptions). Original owners of Roth IRAs are exempt from RMDs. Beneficiaries of all IRAs and employer plans must take RMDs based on their age and relationship to the original owner.Contributions to employer-sponsored plans and traditional IRAs are generally made on a pre-tax or tax-deductible basis and accumulate tax deferred. Distributions are taxed as ordinary income and may be subject to a 10% federal income tax penalty if withdrawn prior to age 59½ (with certain exceptions). Nondeductible contributions to a traditional IRA are not taxable when withdrawn, but any earnings are subject to ordinary income tax. Required minimum distributions (RMDs) from employer-sponsored plans and traditional IRAs must begin for the year you reach age 72 (70½ if you were born before July 1, 1949). However, you are generally not required to take distributions from an employer plan as long as you still work for that employer.

1) Employee Benefit Research Institute, 2020

2) Other options when separating from an employer include leaving the assets in your former employer’s plan (if allowed), rolling them into a new employer’s plan, or cashing out (usually not wise).

3)If you are not covered by a workplace plan but your spouse is covered, eligibility phases out at MAGI of $198,000 to $208,000 for joint filers in 2021 ($204,000 to $214,000 in 2022).

Copyright 2006- Broadridge Investor Communication Solutions, Inc. All rights reserved.

Broadridge Investor Communication Solutions, Inc. does not provide investment, tax, or legal advice. The information presented here is not specific to any individual’s personal circumstances.

To the extent that this material concerns tax matters, it is not intended or written to be used, and cannot be used, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances.

These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable—we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA / SIPC) and SEC Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Coastal Federal Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

CFS representatives do not provide tax or legal guidance. For such guidance please consult with a qualified professional. Information shown is for general illustration purposes and does not predict or depict the performance of any investment or strategy. Past performance does not guarantee future results.

Trust Services are available through MEMBERS Trust Company. CFS* is not affiliated with Members Trust Company.